Saving on Health Care and Medicare Premiums in Retirement.

By Joe Signorella, CFP®, RICP®

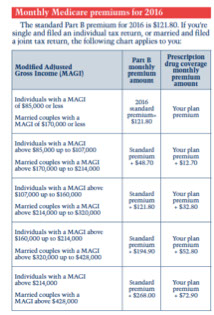

During retirement fixed costs are essential to be managed and kept low to maximize disposable monthly income. One of the highest fixed costs in retirement are health care and Medicare expenses which happen to be the most expensive in retirement. Medicare premiums are formulated for cost based on a retirees MAGI or modified adjusted gross income. Meaning what you pay on a monthly basis for the deducted Medicare premiums from your social security check are based on your income. By lowering your “taxable” retirement income can give you savings.

Certain retirement income streams have tax advantages to keep income lower than traditional portfolio distributions that increase taxable income in retirement. QLAC or Qualifying Longevity Annuity Contract, non-qualified income annuities such as Longevity annuities that use non-IRA dollars, Roth accounts, health savings accounts and permanent life insurance loan distributions are all tax- advantaged way to lower a retirees tax bill with respect to Medicare premiums.

Speaking from the Chicago Retirement Income Summit, Peter Stahl, CFP® stated “The savings are real,”. For example, moving a married couple's tax bracket one threshold lower can save them $65,000 in Medicare costs over a 20-year retirement. And the savings are especially important given “health care inflation isn't grocery-store inflation or Home Depot inflation” — Medicare Part B inflation runs at 7.87% and Prescription Drug Plan Part D is at 7.12%.

Management of RMD, required minimum distributions at age 70 ½ from IRA is also key. Using a QLAC (Qualifying Longevity Annuity Contract) the deposit is not in the RMD calculations for tax. Excluding this amount will automatically lower a retirees RMD tax to over $10,000 in a retirees lifetime and in turn lower one’s modified adjusted gross income.

Get Your Quote in 1 Minute or Less!

<<<<<<<<<<<<<<

Give us one minute and we’ll give you an instant live QLAC annuity quote. It’s that easy. Then, if you like the rates (and we’re pretty sure you will), simply apply online along with your temporary locked in income rates.

The quote is free and there is no commitment. We don't sell your information or forward it onto a third party.

QLAC Qualifying Longevity Annuity Contract | Copyright 2012-2019 Income Quote LongevityInsurance.com