CPI-U vs Fixed Percentage amount COLA?

After Income selection date you have an option to include Cost-of-Living Adjustments or COLA rider. COLA is an annual increase in payments which can come in the form of a fixed annual increase from 1% to 5% or linked to an annual inflation index such as the CPI-U just like your social security income increases. This increase ensure that the purchasing power of income is not eroded by inflation which is running historically under 3% per year for the last ten years.

By selecting your annual increase, CPI-U or Fixed percentage, at application your longevity annuity income payments start off lower when selecting the COLA option. Example: Male age 70 deposits $50,000 into a longevity annuity and selects to start income in ten years at age 80 without COLA option. His annual income payment at age 80 will be $10,820 per year fixed until his death. If he selected the COLA 3% annual increase option at age 80 the first years payment would start off lower at $9,142 in the first year but increase every year by 3% compounded. The total income received “break even” is in year twelve where total payments received equal each other. The COLA 3% increase will give more total dollars of income from year twelve on in this example.

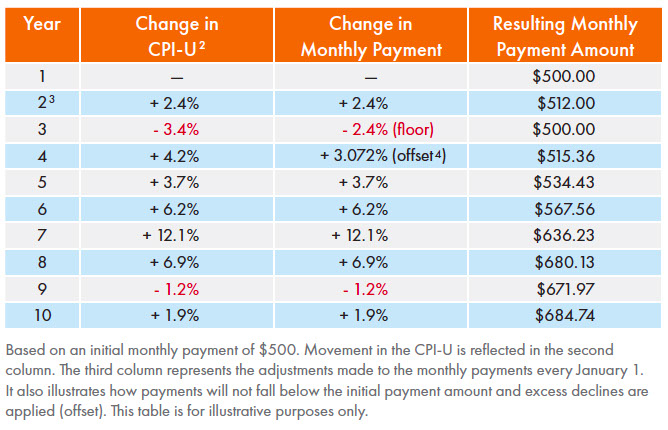

The most common choice would be just give me the CPI-U index option as that will always rise my income payments without a cap or ceiling like in was the 1970's again. That is not how it works with the CPI-U option in longevity annuities. Let look at the example below.

In year three CPI-U was negative and the calculation for income payments was reduced to the floor. The floor would be the lowest income payment during the start of the QLAC; usually the first payment. In the above example the average annual inflation (CPI-U) for the ten year period was 3.28%. If you where to take a constant 3.28% annually your income payments in year 10 would actually be almost 1% higher because there are no negative years in that calculation! This concept is very important to understand. It is not always the better options to take a inflation adjustment off of an index like the CPI versus a constant fixed annual increase. Currently American General AIG American Pathway DIA has the CPI-U inflation adjustment option.

QUICK FACT

CPI-U: Consumer Price Index for Urban Consumers

This index is was created by the Bureau of Labor Statistics to measure the urban population change in a set group of consumer goods. The groups include:

FOOD AND BEVERAGES

HOUSING (rent of primary residence, owners' equivalent rent, fuel oil, bedroom furniture)

APPAREL (men's and women's, jewelry)

TRANSPORTATION (new vehicles, airline fares, gasoline, motor vehicle insurance)

MEDICAL CARE (prescription drugs and medical supplies, physicians' services, eye care, hospital services)

RECREATION (televisions, toys, pets and pet products, sports equipment, admissions)

EDUCATION AND COMMUNICATION (college tuition, postage, telephone services, computer software and accessories);

OTHER GOODS AND SERVICES (tobacco and smoking products, personal services, funeral expenses).

Get Your Quote in 1 Minute or Less!

<<<<<<<<<<<<<<

Give us one minute and we’ll give you an instant live QLAC annuity quote. It’s that easy. Then, if you like the rates (and we’re pretty sure you will), simply apply online along with your temporary locked in income rates.

The quote is free and there is no commitment. We don't sell your information or forward it onto a third party.

QLAC Qualifying Longevity Annuity Contract | Copyright 2012-2019 Income Quote LongevityInsurance.com