CD and an Immediate Annuity vs QLAC.

By Joe Signorella, CFP®, RICP®

What is the better retirement income solution for a retiree wanting guaranteed lifetime income later in life? One popular choice has been to save money in a bank CD paying an interest rate but protecting principal within the safety of the bank protection. Then to maximize lifetime guaranteed income by purchasing an SPIA also called single premium immediate annuity, later in retirement. Lets look at an example of a 60 year old retiree who invests $50,000 into a series of long term CDs today and reinvesting those funds into future CDs until the age of 80.

Discover Bank is paying 2.00% for a 5 yr CD. Holding that rate over a 20 year period would grow your initial deposit into $74,297 at age 80. Then the retiree would turn around and purchase an immediate annuity for lifetime income giving her $644 per month. All of the amounts would be guaranteed by the financial institutions. Compare this to investing that $50,000 today into a QLAC would produce a guaranteed lifetime income at age 80 of $1,020 per month.

Summary:

- Age 60 purchase $50,000 CD then 20 yrs later purchases a $74,297 immediate annuity with the proceeds. Income = $644 per month for life at age 80.

- Age 60 purchases $50,000 QLAC (Qualified Longevity Annuity Contract). Income = $1,020 per month for life at age 80.

That is an increase of 58% with a QLAC versus CDs and immediate annuity.

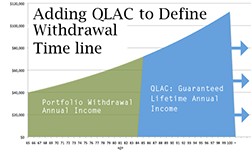

QLAC is a longevity annuity also know as a Qualifying Longevity Annuity Contract. Usually a one time deposit for a guarantee lifetime income at a future date chosen by the policy holder. Options include inflation income adjustments, death benefits of deposit and joint annuitant for income.

What if she waits until age 85 to receive income. The combination bank CD and immediate annuity purchased at age 85 would give her $918 per month for life.

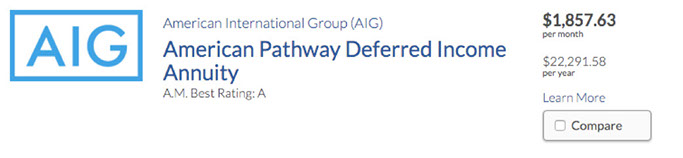

QLAC purchased today with income starting at age 85 would produce $1,857 per month!

Summary:

- Age 60 purchase $50,000 CD then 25 yrs later purchases a $82,031 immediate annuity with the proceeds. Income = $918 per month for life at age 85.

- Age 60 purchases $50,000 QLAC (Qualified Longevity Annuity Contract). Income = $1,857 per month for life at age 85.

That is double (102%+ increase) the income produced from the bank and annuity combo.

QLAC income produce what is know in the retirement planning world as retirement alpha. Alpha is defined as having the most power in a group, dominate compared to others. For a no annual fee QLAC and free quote see www.QLACQuote.com where we compare all QLAC approved companies to find you the highest income amount.

Get Your Quote in 1 Minute or Less!

<<<<<<<<<<<<<<

Give us one minute and we’ll give you an instant live QLAC annuity quote. It’s that easy. Then, if you like the rates (and we’re pretty sure you will), simply apply online along with your temporary locked in income rates.

The quote is free and there is no commitment. We don't sell your information or forward it onto a third party.

QLAC Qualifying Longevity Annuity Contract | Copyright 2012-2019 Income Quote LongevityInsurance.com