(.png?crc=186348793)

QLAC = QUALIFYING LONGEVITY ANNUITY CONTRACT

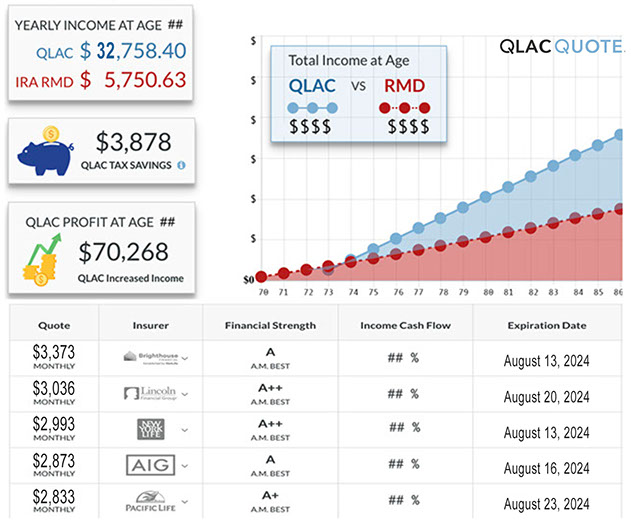

Getting instant QLAC quotes from top insurance companies is easier with our live instant QLAC calculator. QLAC will allow you to use less of your retirement savings, increase your income by 20% with guaranteed lifetime income, and defer your required minimum distribution to age 85.

As retirees live longer the government has passed a law that allows $200,000 (increased in 2023) of your December 31st prior year IRA balance to be invested into a "qualified" longevity annuity contract or QLAC therefore avoiding RMD until the maximum age of 85. This low cost no annual fee deferred income annuity encourages guaranteed lifetime income in retirement.

QLAC (Qualifying Longevity Annuity Contract) Rules:

1. Funding: IRA balance up to $200,000 (Increased to in 2023), index to annual inflation amounts of $10,000 in future years.

2. If accidental over funding of QLAC contribution limits you can correct the amount funding without penalty.

3. Income start date of your QLAC must be no longer than one month past your birth month at age 85.

4. No variable annuities or index annuities allowed to be a QLAC according to the IRS rules.

5. Return of deposit death benefit is allowed before and after income commencement date, however amount can not be more than deposit.

6. Income payments can increase in the future by additional riders: cost-of-living adjustments that are constant (1% to 5% increase) or by a index such as the CPI-U inflation index such as with American General AIG American Pathways deferred income annuity and Principal's QLAC.

7. Lifetime payments can be calculated on the IRA holder and a spouse or partner's life.

8. QLAC, qualified longevity annuity contract, has no reporting requirement for the contract holder.

Pros and Cons of QLAC (Qualifying Longevity Annuity Contract)

Pros

-

No IRS RMDs (Required Minimum Distributions)

- QLAC dollars are not calculated into your IRA RMD calculation which allows you to skip those investments until age 85 when income starts.

-

Tax Deferred IRA

- IRA to QLAC IRA transfer keeping your tax status

-

Guaranteed Income

- Knowing how much lifetime income you will have with a QLAC helps your income planning in retirement.

-

Extended Health Care (LTC) Costs Solutions

- Long Term Care Costs in retirement are a major threat to your retirement funds. QLAC's guaranteed income later in life and the QLAC flexibility to change income start dates with some carriers will help combat LTC costs in the future.

-

Beneficiary and Spousal Protection

- QLACs have the option to include a death benefit or refund option along with including your spouse for income payments.

Cons

-

Deposit Limits on QLACs

- Up to $200,000 IRA balance (increased on 2023)

-

Lack of Inflation Adjustments to Income

- Some carriers now offer CPI and fixed inflation adjustments to income at the income start date.

-

Lack of Control

- QLAC income doesn't start sometimes for decades and use of the invested assets are not accessible in the short term deferral period. However you also have your total retirement funds "earmarked" for retirement income, so all of your funds

-

Insurance company keeps my money

- if you do have life income only option chosen and you pass away before that income starts you do lose your QLAC deposit. However the insurance company uses that higher income option of life only to guarantee a higher income payment if living. Funds are pooled to give this mortality credits or longevity credits to other QLAC holders. There is always the refund options so you dont lose that QLAC deposit at death.

10 QLAC Quick Facts

- You can invest your IRA and 401(k) balance in a QLAC—to a maximum of $200,000 (increased in 2023)

- If a husband and wife each have IRAs, both can max out on QLACs, Total $400,000.

- A QLAC can start paying out at any age, but no later than age 85.

- A QLAC can include inflation adjustment annually.

- Money in a QLAC is invisible to the IRS when calculating required minimum distributions, permitting you to defer the tax bill for as long as 15 years.

- Because QLACs insure against running out of money in retirement age, they are often referred to as longevity annuity or longevity insurance, insurance against living too long.

- The fastest-growing age group in America are those age 90 and older.

- For a 65-year-old couple, there’s a 45% chance that either the husband or wife will live to at least

- If a 65-year-old man invests $100,000 in an immediate-pay annuity, he could get checks of $550 a month starting right away. The same investment in a life-only QLAC with an income start date of age 85 would pay more than six times as much: $3,575 a month.

- An optional return-of-premium/deposit rider can guarantee that if you don’t collect at least as much as you paid for your QLAC, 100% of the difference will go to your named heirs.

How do you get your IRA money "over" to a QLAC and will it be a taxable event on the move/ transfer? When you apply for the QLAC there is a transfer form you authorize that allows the insurance company to contact your brokerage or mutual fund company that holds your current IRA dollars. Your authorization will start the process of an external transfer that is NOT a taxable event since it is going from an Individual Retirement Account, IRA to a QLAC, Qualifying Longevity Annuity Contract. QLAC is an IRA or Individual Retirement Account where there is one account owner. Like to like movement will not trigger a taxable event. This transfer takes about 10 business days without any additional contact on the depositors behave.

Washington DC, February 2, 2012

The Internal Revenue Service, Department of Treasury and The Obama Administration published a report that encouraged income annuities in company retirement plans and Individual Retirement Plans or IRA. With the demise of corporate pension plans lifetime income for retirees was their goal for the proposed new regulations. A new definition came out of the report. QLAC, or Qualified Longevity Annuity Contract. It is a “pure” deferred income annuity that pays the annuitant later in life, say at age 80. The advantage of a longevity annuity also called longevity insurance is the little initial deposit of premium dollars are needed to guarantee bigger income payments later in retirement years. Some key requirements to QLACs:

The maximum amount of the premiums paid to a QLAC under a plan is the lesser of a dollar limit or a percentage limit, each of which is described below.

1. Dollar Limit – The dollar limit is $100,000 (adjusted for inflation) minus the total premiums paid for all QLACs in all applicable plans on behalf of an account owner.

2. Percentage Limit – The percentage limit is 25 percent of a participant’s account balance on the date of a premium payment minus previous premiums paid to the QLAC or any other QLAC purchased for the account owner in the plan. For purposes of the percentage limit, all IRAs (other than Roth IRAs) are treated as a single plan.

One advantage of QLAC, Qualified Longevity Annuity Contract, is your retirement funds in a “qualified” account are not subject to RMD (Required Minimum Distribution).

Another key to the regulation in Washington is the use of longevity insurance in the form of a fixed annuity, meaning that QLAC cannot have a death benefit, stock market exposure or cash value built into it. This is to keep the actuarial cost down and upside for the longevity insurance policy holder.

This is still a proposal by the Obama administration and not officially a law or ruling. Lets hope for the best.

Update: May 2012 www.IRS.Gov website states:

“Purchasing longevity annuity contracts could help participants hedge the risk of drawing down their benefits too quickly and thereby outliving their retirement savings. This risk is of particular import because of the substantial, and unpredictable, possibility of living beyond one’s life expectancy. Purchasing a longevity annuity contract would also help avoid the opposite concern that participants may live beneath their means in order to avoid outliving their retirement savings. If the longevity annuity provides a predictable stream of adequate income commencing at a fixed date in the future, the participant would still face the task of managing retirement income over that fixed period until the annuity commences, but that task generally is far less challenging than managing retirement income over an uncertain period.”

Update: November 2013 www.TAX.Gov website:

I have attached an audio presentation link from Director of IRS Employee Plans Customer Education and Outreach. Lifetime Annuity Guidance Phone Forum on the proposed Lifetime annuity IRS regulation (REG-115809-11).

"The primary purpose of this proposed regulation is that under the existing 401(a) (9) regulations it is extremely difficult to buy a longevity annuity. Prior to the regulation or until the regulation become finalized, you would need to take into account the value of the longevity annuity in determining your minimum required distribution. There is a couple of issues there, one it is difficult to value, and two, it might result in situations where you might have to use up quite a bit of the non-longevity annuity portion of your account.

With that in mind, we came out with the proposed QLAC regulations. The QLAC regulations define what a "QLAC" is. It's a qualified longevity annuity contract. In the regulation there is a limitation on the premiums that can be used to purchase the QLAC. It is basically the lesser of $100,000 or 25% of your account value. There is also a maximum age that a QLAC can be when payments can begin. They can't go any higher than age 85.

There are limits on the benefits payable after the death of the annuitant. In general, if the employee dies, the benefit must be a life annuity. If it is a spouse, the life annuity can begin upon the death of the annuitant or it can begin when the employee would have reached the age he intended to annuitize, the annuity starting date that is. But if it is a non spouse, the payments must begin immediately or the next year after the employee dies.

There is also some other requirements for QLACs in the proposed regulations. We don't allow variable annuities. The regulations don't allow variable annuities. The QLACs can't have cash values. The contract itself must say that it is a QLAC and it must satisfy all the other 401(a) (9) requirements. For example, you can't have a QLAC that has an automatic COLA of 10% a year. You could not purchase a contract that paid $1000 a year at age 85 and then $1100 at age 86 going up by 10% a year because that would be a violation of the other part of the 401(a)(9) regulations." -source Mark O'Donnell, Director of IRS Employee Plans Customer Education and Outreach; Lifetime Annuity Guidance Phone Forum.

Update: June 2014:

When will the proposed QLAC (qualified longevity annuity contracts) rule become active? We have contacted the lead lawyer assigned to the proposal and was stated to us that if and when a law becomes policy it will be done through the IRS Federal Register site. This means at any time when the Register is published the proposal can become law.

Some of the concerns on the proposal was the zero death benefit, zero cash value, and no variable or participating dividend paying contracts such as Northwestern Mutual Select Portfolio Deferred Income Annuity, would hinder the public's use of longevity insurance or longevity annuities in their retirement plans.

I seems the insurance company's executives are forecasting the passing of the QLACs by updating their longevity insurance products like MetLife's Guaranteed Income Builder. MetLife has added a a commuted value during the deferral period. MetLife allows deferral of income to age 75 in an IRA one of two companies to allow this.

Update: July 2014:

Longevity Annuity or Deferred Income Annuity’s job is to accept deposit today in return for income for life in the “delayed” future, sometimes decades later. This could cause a problem with the Required Minimum Distribution IRA rule that states you must take income at age seventy and a half in qualified funds, retirement accounts.

On July 2nd quietly Treasury department had issued Treasury Regulations under 1.401(a)(9)-6 that states as long as a longevity annuity meets certain requirements, discussed below, it becomes a "Qualified Longevity Annuity Contract" (QLAC) and automatically be declared to satisfy the required minimum distribution (RMD) rules even though income payments don't begin until later, even after age 70 ½.

Premium Deposit Limits:

$125,000 or 25% of your combined IRA balances as of the last date of valuation before your opening the longevity annuity or QLAC. The dollar limit is index for inflation in $10,000 increments. Historically with around 3% annual inflation that $10,000 increases to the premium limits would increase around every three years. Regulations also provided a way to correct the over funding of a QLAC and return the excess deposits to your IRA account, which would NOT disqualify your qualified longevity annuity contract status.

Death Benefits:

The regulations allow return of premium death benefits both before and after the annuity income starting date. If the owner of the longevity insurance or QLAC passes away after the age of 70 ½ the death benefit is like a required minimum distribution for that year and is not able to be rollovered.

Types of Longevity Annuities:

Treasury Department stated that index annuities and variable annuities that have sub account like mutual funds are NOT allowed to used as a qualified longevity annuity contract (QLAC). Dividends from mutual life insurance companies are allowed with certain payments restrictions in the regulations. No fancy accounting tricks to boost large income payments to contract holder later in life. No stated cash value for QLAC.

Requirements:

Annuity contract have to state their intention to become a QLAC by January of 2016. This most likely will be done thru an addendum or rider to the annuity contract. Also the IRS requires an annual filing form that states the fair market value of the QLAC. Details to come later in the year.

Update: January 2015:

In November of 2014 AIG annuity division was late to the DIA party on creating a deferred income annuity. That delay helped AIG's American General become the first QLAC approved vendor for IRA and 401(k) marketplace by writing QLAC language into the contract if it were to be approved by the IRS. “Because of the interest we had and the feedback from clients on the proposed qualified-longevity-annuity guidelines, we intentionally developed the DIA to take those requirements into account,” said Stephen Brenneman, vice president of AIG's fixed annuities product development. “We didn't have to create a new product to be compliant; we created an endorsement for QLAC to accompany the annuity we created a year ago.” AIG's QLAC advantage is that policy holders can get a quote that takes out the death benefit before and after income starts to maximize income at age 85. Other QLAC approvals won't come until spring/summer of 2015 from other annuity companies.

Update: March 2015:

There are now three QLACs on the market with the addition of Principal Financial Group's Deferred Income Annuity and Lincoln Financial Group's Deferred Income Solutions. Both require you to take the return of deposit on death rider if you pass away before income start age. Principal has the option to take "Life only" income which will allow a potential higher income payment than Lincoln's requirement of "Life with a Cash Refund" after income starts. Both QLACs have inflation COLA increases from 1% to 4%. Principal does have an (Consumer Price Index Urban) CPI-U cost of living adjustment (COLA) rider that will increase income payments along with the given CPI-U index every year.

Update: April 2015:

The fourth Qualified Longevity Annuity Contract (QLAC) provider, A.M. Best rated A+, Pacific Life Insurance launched a QLAC which is a solution for IRA owners to save on taxes earlier in retirement along with increasing their guaranteed lifetime income payments in the future . “It can be a source of frustration for clients who would prefer the option to take a smaller RMD distribution, because they may not need to take as much income as required early in retirement,” says Christine Tucker, vice president of marketing for Pacific Life’s Retirement Solutions Division. “Greater required minimum distribution amounts may bump retirees into a higher tax bracket. It can also affect the percentage of Social Security benefits exposed to taxation. For some, it may even increase the premiums they pay for Medicare Part B and D. This is why Pacific Life’s Pacific Secure Income as a QLAC may make sense.”

Pacific Life Secure Income QLAC's have inflation COLA increases from 1% to 4% and a one time flexible income start date change within a five year period. Pacific Life's Secure Income also has an accelerated income feature for a one time "advance" of 6 months of income payments which would resume to lifetime monthly income. Death benefits before and after income start dates are also available.

Update: August 2015:

Hello New York Life Insurance Company and MetLife welcome to the QLAC party. The two big annuity carriers have introduced their QLAC approved income annuity in most of the 50 states and the District of Colombia. New York Life's QLAC is called Guaranteed Future Income Annuity II and is A.M. Best rated A++. It has the cost of living adjustment option of 1% to 5% per year starting at income commencement. Return of deposit option at death before and after income starts is also a feature along with Life only. Joint spousal/partner annuitant income option are also available.

MetLife's Qualifying Longevity Annuity Contract (QLAC) is marketed under the GIB, Guaranteed Income Builder name. A.M. Best rated A+ since inception, the Guranteed Income Builder or GIB from MetLife has all the optional features as the rest: cost-of-living income adjustment, return of deposit death benefit, accelerated income payments and joint life annuitization.

Update: September 2015:

New York Life Insurance Company has enhanced their current QLAC status Guaranteed Future Income Annuity with the launch of Mutual Income Annuity. Building off New York Life's mutual status as a life insurance company this new Mutual Income Annuity has the potential to pay dividends to it's policy holder in addition to guaranteed lifetime income.

According to New York Life's director Dylan Huang "With the launch of New York Life Mutual Income Annuities and the availability of our deferred income annuities as qualifying longevity annuity contracts (QLACs), we are giving pre-retirees and retirees the guarantees they want and the ability to customize retirement income to meet their needs."

.

Update: December 2015:

The only approved for sale QLAC for a 401k plan on the market is MetLife's QLAC called Retirement Income Insurance. With higher administrative plan costs on a 401k QLAC and federal government ERISA requirements make having a 401k QLAC option hard to provide. Retirement plan administrators also don't have the technology to track in plan annuity holdings on older computer systems. But, MetLife also has a separate retail IRA QLAC, called Guaranteed Income Builder which is one of the top income choice for IRA owners.

Update: February 2016:

Society of Actuaries (SOA) which life and annuity insurance companies base their products structure on release the updated 2014 mortality tables. Theses updated table reflect the continuing trend in longevity and life expectancy. The updated mortality tables for 2014 will require insurance companies to lower their income payout rates to adjust to longer life spans. A 65 year old male average life expectancy is now increase by 2 years to 86.6 years of age. A 65 year old female average life expectancy is now increase by over 2 years to age 88.8 years of age. What will the next 10 years bring to this growth in life expectancy?

Update: June 2016:

Mutual of Omaha is a Fortune 500 mutual insurance company based in Nebraska. Rated A+ by A.M. Best, May of 2016 Mutual of Omaha had successfully produced a QLAC called Deferred Income Protector for the retail market. Annuitants age 40 to 75 yrs old can defer income payments out up to 40 yrs or to age 85 according to Treasury QLAC regulations. Joint and single annuitant payout options are available along with a return of deposit death benefit called Cash Refund. Optional inflation income protection is available from 1% to 3% but does not have a CPI-U option. You may change the income start date once. You may choose to move the date 5 years earlier or later than the date originally selected on the QLAC.

Update: September 2016:

Your social security benefits can be taxable up to 85 by filing jointly and making over $44,000 in provisional income. Eliminating some of your mandatory RMD after age 70 1/2 from your IRA with a QLAC will help save on taxes up to the age of 85.

Update: October 2016:

University research paper called "Putting the Pension back in 401K Plans" from the National Bureau of Economic Research states that longevity insurance, aka QLACs can almost pay for themselves. Researchers studied the use of longevity annuities in Germany and Singapore, where retirees are required to purchase them with part of their retirement savings. If you purchased a longevity annuity with 15% of your qualified 401k or IRA at retirement you would be able to save less in your retirement accounts before retirement, spend between five percent and twenty percent more during retirement, and probably have much more spending power after age 85 than the person without access to a QLAC or longevity annuity.

Update: January 2017:

Longevity risk with financial planning is living longer that your financial resources. To bring more information to this topic the Society of Actuaries (SOA) and the American Academy of Actuaries have created a longevity calculator at www.longevityillustrator.org. Some key point that this calculator will highlight are: Couple longevity risks, living longer than you believe, and many different factors that control your longevity. Taking this information from the calculator and applying it to your financial retirement income plan can potential help make your assets last for the duration of your retirement. Social Security planning, QLACs (Qualifying Longevity Annuity Contract) and longevity annuities also can help increase your income during the longevity of your retirement.

Update: February 2017:

Metlife's Guaranteed Income Builder QLAC will go thru an company structure change next month. MetLife has separated their US Life and Annuity retail business to a division called Brighthouse Financial. At that time that business will still be under the MetLife structure for ratings and financial strength. However it is MetLife's intention to spin off Brighthouse Financial via stock distribution or IPO in the coming months. It is understood that the financial rating companies will uphold the high "A" ratings currently given to MetLife. Brighthouse Financial will be on of the the biggest retirement annuity providers in the United States. More to come.

Update: April 2017:

A study commissioned by the Bankers Life Center for a Secure Retirement (CSR) has found baby boomers are too dependent on Social Security, with 38% now the monthly check will likely be their primary source of retirement income. That's up more than 25% from before the financial crisis of 2008, a year which seems to have changed the financial landscape on a number of fronts. Before 2008, Boomers were younger and a lot more optimistic about retirement. Then, about 43% said they expected personal savings or earnings from a job to be their primary source of income during their Golden Years. "Social Security was designed to be a safety net, not a primary replacement for savings or income," said Scott Goldberg, president of Bankers Life. "Those who are in or near retirement should consider the various ways they can create future income to help achieve a secure retirement. There are products readily available in the marketplace that can help."

Update: May 2017:

More large companies are transferring their company pension plans obligations to insurance companies income annuities to pay out employee benefits. "Sears Holdings Corp., Hoffman Estates, Ill., purchased a group annuity contract from MetLife to transfer about $515 million in U.S. defined benefit pension plan liabilities, the company announced in May." If large companies are purchasing deferred income annuities, also called longevity annuities and the Internal Revenue Service "blessed" longevity annuities with a special tax deferred of RMD (required Minimum distribution) with the QLAC. You might want to take a look at the advantages of a longevity annuity also called a QLAC or Qualifying Longevity Annuity Contract

Update: June 2017:

MetLife did a study of hundreds of retirement plan participants called Paycheck or Pot of Gold Study. In this study some key mistakes were observed as most retirees with an average of $192,000 took the lump sum balance instead of the annuity lifetime monthly income quote option. Their "mistake" in taking the lump sum balance was that on average the lump sum was depleted on average of 5 and one half years. The average length of time those

who who took the lump sum option expect the money to last up to 17 years. 95 percentage of retiree plan participants in the study believe they are "better off" financially since they chose the lifetime income annuity over a lump sum. Create your own lifetime income annuity with a QLAC or longevity annuity.

Update: August 2017:

Kroger grocery store food chain will be funding its underfunded pension plan in the tune of $1 billion dollars by taking a loan in the open bond market. in 2016 Kroger made $2 billion dollars total to put this loan in perspective. Along with the loan to the underfunded pension plan the store food chain will be offering lump sum payouts and off loading these pension obligations. Kroger stated the low interest-rate loans available, potential changes coming to the tax code and plans by the Pension Benefit Guaranty Corporation, PBGC which guarantee partial pension payments to raise fees as reasons for the timing of the announcement. Create your own lifetime income annuity with a QLAC or longevity annuity that is NOT subject to underfunding and partial payments.

Update: October 2017:

Social Security monthly benefits for 2018 will increase two percent. That is an average increase of $25 a month for retirees. The 2018 increase is the largest social security monthly income in the last six years. However Medicare Part B premiums might devour that increase in 2018 with the "hold harmless" provision largely eliminated in 2018 which protected increases in Medicare Part B. "Their Social Security won't be reduced, but Part B would take every penny of their COLA," said Mary Johnson, a policy consultant at The Senior Citizens League.

Update: December 2017:

According to an IRI Jackson retirement survey most do not believe Social Security will provide sufficient income, and they do not expect to receive income from a pension. Most younger consumers will plan to use their savings to provide themselves with income during retirement, and are concerned about the health care costs in retirement that will impact their retirement savings. Most surveyed were receptive to financial products that

can provide guaranteed lifetime income like income annuities. Likely to exhaust their financial resources at some point during their retirement years annuities can help solve retirement challenges. Income annuities like QLACs, are the only financial products that can provide the guaranteed lifetime income consumers say they want. More than six in 10 consumers age 25-34 plan to use their savings for income, and more than 90 percent want guarantee lifetime income. Yet fewer than one third understand annuities can provide such income or plan to purchase annuities with their retirement savings.

Update: February 2018:

“The dollar limitation on premiums paid with respect to a qualifying longevity annuity contract under § 1.401(a)(9)-6, A-17(b)(2)(i) of the Income Tax Regulations is increased from $125,000 to $130,000.” That is an increase to $130,000 or 25% of your IRA or 401k balance from the previous year, whichever is the lesser of. The IRS on January 1st of 2018 made that effective with this document on their website.

The future increase was a little shocking as the original QLAC language in 2014 was for $10,000 increase pegged to inflation in future years. This is only a $5,000 increase to the limit which might cause funding problems in the coming years. Most financial advisers will not open a $5,000 QLAC annuity because of the paperwork and very low commission paid to the adviser. The following QLAC insurance companies offering the low $5,000 initial deposit are: Guardian, Mutual of Omaha, New York Life, and Brighthouse (formerly MetLife). The good news is the limit did increase and it seems the IRS is still in favor of the QLAC law and benefits it gives retirees.

Update: March 2018:

The Center of Retirement Research of Boston College did a study asking if the Required Minimum Distribution method of retirement income a 401k plan was sustainable. With the reduction of pension plans and the huge increase in 401k defined contribution plans retirement income has become difficult to manage. The RMD method outlined by the IRS table was surprisingly effective as it is based on two good strategies. It was simple to follow based on a life table according to age by the IRS. It was also calculated on a percentage of your balance on a yearly basis. Starting around 4% ans increasing with age to over 16% in your late 90's. This allows lower income when your account balance is high and higher retirement income when your account is lower with advanced age. If you start taking IRA QLAC distributions in you 80's the total income is higher within a few years with the guaranteed income from a QLAC versus RMDs.

Update: June 2018:

The Social Security Board of Trustees on the first week of June 2018 released its report on the long-term financial stability of the Social Security trust funds, finding the asset reserves of the Old-Age and Survivors Insurance and Disability Insurance Trust Funds are projected to become depleted by the year 2034, with 79% of benefits payable at that time. Also Medicare trust fund would by brought to zero by the year 2026. Prudential Financial's Rob Fishbein stated “It is time to take very seriously the challenges pre-retirees face.” This reduction in the trust funds fundability by years will put pressure on the system by way of lower cost-of-living adjustments, increasing the full retirement age or cutting benefits in the years to come. The added value of personal pensions and guaranteed income will come at a higher cost to retirees in the years to come. Locking in those income rates now with QLACs, and income annuities will become invaluable.

Update: August 2018:

Vanguard along with Mercer Health and Benefits study: Planning for Health Care Costs in Retirement focused one retiree future care costs in retirement. One key solutions talked about was income annuities and qualified longevity annuity contracts, QLAC, may be worth considering for some married retirees, not so much as a source of funding for long-term care, but rather as insurance for a surviving spouse. A lifetime guaranteed income source to supplement Social Security for a surviving spouse can be a way to reduce the financial effects of a low probability, high-cost long-term care event that significantly reduces assets.

Update: September 2018:

A recent USA Today article gives you retirement advice on how to kick the can down the road on your RMDs. Walter Pardo also recommends that older investors with large retirement accounts consider purchasing a qualifying longevity annuity contract, or QLAC. “A QLAC can help older clients with large IRAs to defer at least $130,000 of an IRA until age 85,” he says. A QLAC is, in essence, a deferred income annuity that allows income to begin beyond age 70½ without conflicting with RMD rules. With your lifetime income from Social Security a QLAC compliments your income guarantee base.

Update: October 2018:

The first week of September President Trump signed an executive order requiring the Depart of Labor and The Treasury Department to look at some key measurements related to your retirement money. This will take months if not years to possible become law but at least the idea is center stage. Some of the few key points are the following:

- Raise the cap on contributions to a qualified longevity annuity contract, or QLAC, from $130,000 to $200,000.

- Take away contributions to a traditional IRA after age 70½.

- Raise the age beyond the current 70½ age for starting your RMD,required minimum distributions.

- No RMD, required minimum distributions from IRA accounts with less than $50,000 or $100,000 in corporate 401k and IRAs.

Social Security Administration announced Thursday that the 2019 cost of living increase will be 2.8%. That is an increase from 2018's 2% COLA that benefited over 60 million retirees. 2019's 2.8% increase will boost the average social security retirees income by forty dollars a month. However with 2018 hold harmless Medicare premium "freeze" the premium increase had a ceiling level to COLA in 2018. So 2019 COLA income increase will be eaten up by the jump in Medicare premiums on Part B in 2019.

Update: December 2018:

High net worth buyers don’t need to solve for income as much as they need to solve for living longer, aka longevity. So investing the max amount in a QLAC at $130,000 to help fund life expectancy to the age of 95 or older, at a time when the yield curve is back on the rise, is why wealthy buyers are interested in QLACs in 2018. Besides the RMD tax deferral a QLAC gives, fixed guaranteed income payments from a QLAC later in life also help retirees budget and plan for prescription drugs, medical expenses which include long-term care. Required Minimum Distribution (RMDs) from an IRA are calculated from IRS tables each year after age 70.5 years old. This RMD formula make it difficult to project annual withdrawal income amounts compared to projected retirement income needs in retirement. QLAC will give you a fixed guaranteed lifetime income payment so you can plan for retirement income.

Update: February 2019:

New research report by the Employee Benefit Research Institute (EBRI) found that 401(k) plans that purchased a deferred income annuities (DIAs also called QLACs when used with qualified dollars) at age 65 with no death benefits improved retirement readiness at all ages. The allocation amounts used for the QLAC purchase was in different percentages all under 25% of the participates 401(k) balance. This fits perfectly with the IRS rules of using no more than 25% of your combined IRA account balance to fund a QLAC.

The research report authored by EBRI Director of Research Jack VanDerhei explains, DIA/QLACs are designed to reduce the probability of outliving savings by providing monthly benefits in the later stages of retirement. “Because of their delayed payments, QLACs could be offered for a small fraction of the cost for a similar monthly benefit through an low cost annuity that starts payments immediately at retirement,”.

Update: March 2019:

New report by Fidelity Investments states that Baby Boomers are putting their retirement portfolios at risk. Roughly half of baby boomers have their IRAs and 401(k) plans invested in riskier allocations than Fidelity suggests for their age group. Fidelity recommends having around 54 percent in stocks and the rest in fixed assets like bonds, money market funds, certificates of deposit, or fixed annuities. “If there was a market downturn, they could lose a significant chunk of what they’ve worked so hard to save,” said Meghan Murphy, the vice president of thought leadership at Fidelity. Eighty percent of Fidelity's 401K Baby Boomers age 55 -73 years old have their entire portfolio allocated to stock equities. “Baby boomers are more likely to live to 90 or 100 years old,” Ed Slott, CPA said. “Some may feel, ‘I’m getting close to retirement, but I’m still in it for the long haul.’”

Update: April 2019:

New congressional bill going thru congress called Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019. SECURE Act will make it easier for Defined Benefit plans and 401K plan to offer lifetime income annuities such as QLACs. The act will also allow Required Minimum Distributions or RMDs to be pushed back from age 70 and a half to age 72. This would effect QLACs only from the beginning start ages or one year and a half. Hopefully this bill will make its way to the senate and become law in the coming months.

Update: May 2019:

Pushing back social security claiming ages has been a hot topic for years but some foreign countries are running proposed laws to delay the age of payments. Canada’s Old Age Security (OAS) kind of like social security has proposed changes to their pension program because their Canada and Quebec pension-plan is optional. The proposal has OAS eligibility age increased from age 65 to age 67, while also increasing the maximum postponed retirement age from 70 to 75 giving the retiree who delays more income. With pension plans disappearing and your health and longevity increasing now is the time to lock in the increased QLAC income payments.

Update: June 2019:

Retirement is the time you look forward to later in life, the kids are all grown up and now you get the time to do so many of the things you probably put off because of your career. You need money to do the things you dreamed of later in life, that means monthly income if you don't have it you aren't able to spend your retirement years the way you had planned. According to a recent whitepaper by GOBankingRates, income levels for the average retiree can be very different depending on which state you live. The study examined the average retirement and Social Security income , which are broken out separately, in each of the fifty states. GOBankingRates also include the average rates of those 65 and older moving into the state and out of it to see if there were any correlations. Maryland had the highest median income, including social security income with just over $52,000 per year. Top five below.

The five states with the richest retirees are:

1. Maryland

2. California

3. Virginia

4. Alaska

5. Colorado

Update: August 2019:

The Setting Every Community Up for Retirement Enhancement Act of 2019, or SECURE Act, was passed by the House this year and hopefully will clear the Senate at some point on the back of a Fall 2019 bill. The SECURE Act would change some key issue in retirement rules. Some proposed rule changes are the following: making it easier for small employers to set up and offer 401(k) plans and allowing the creation of “open” Multiple Employer Plans or MEP 401(k)s ; removing the age 70 ½ age limitations on traditional IRA contributions; eliminating the 10% penalty tax to pay for a qualified birth or adoption; delaying the required minimum distribution (RMD) to age 72 from the current 70½; and opening up more options for allowing annuities within retirement plans as the need for guaranteed lifetime income increases with longevity.

Update: September 2019:

The Treasury says the Office of Debt Management is "conducting broad outreach to refresh its understanding of market appetite" for 50- or 100-year debt. The Department of Treasury is looking into selling bonds that mature in 50 or 100 years which would push the longest bond maturity from 30 years to 50 years if created. Negative interest rates overseas and at home record-low interest rates make this an opportune time for the Treasury to issue the longest-term debt it can.

The world’s spreading over $16 trillion pile of negative-yielding securities is forcing investors further out on the global yield curves, in part to finance retirees’ longer lifespans. This expansion to a longer bond maturity will help annuity carriers construct longevity annuities and QLACs investments in the end helping income rates for future income annuities.

Update: November 2019:

The Treasury Department stated in its 2020 Limitations Adjusted Section 415 (d) Notice 2019-59 the following. The qualifying longevity annuity contract (QLAC) under tax code will increase from $130,000 to $135,000 in year 2020. Originally the increase limits were suppose to increase in lots of $10,000 increases however an exception was done years ago to increase the amount to $130,000 from $125,000 in 2017. Future adjustments to this limit will be made in increments of $10,000 going forward.

Update: February 2020:

Now that the QLAC has increased it's deposit limits to $135,000 for the new year, retirees are seeing the benefits of tax deferral until income starts at the most of age 85. Using income later in life from a QLAC can define your income time frame which would help in your retirement withdrawal rate. Knowing you would have lifetime income from a QLAC starting at age 85 you would be able to plan for the defined time frame (example age 65 to 85).

Update: May 2020:

The Corona Virus Aid, Relief, and Economic Security (CARES) Act, was established to help jump start the economy due to economic losses from the pandemic. CARES act allows retirees to forgo taking Required Minimum Distributions (RMDs) from IRAs including many retirement plans 401(k), 403 (b), and SIMPLE IRAs for the current 2020 year. Pensions also called Defined Benefits corporate plans are not included, so if you’re supposed to take distributions from a Defined Benefit (DB) plan you must continue to do so. With the first quarter stock market loss due to the corona virus many portfolios are down and allowing the RMD free pass in 2020 helps retirees avoid locking in losses to get access to cash to pay for their required minimum distributions (RMDs). This RMD waiver applies to any age and also inherited IRA's which help save on taxes.

Update: April 2021:

In October 2020, Ways and Means Committee Chairman Richard E. Neal (D-MA) and Ranking Member Kevin Brady (R-TX) introduced the Securing a Strong Retirement Act of 2020 (the “Act”). Neal and Brady originally introduced the Setting Every Community Up for Retirement Enhancement Act (the “SECURE Act”) of 2019. The Act builds on the SECURE Act provisions to improve retiree's and workers’ longer retirement security and financial wellbeing, and is being referred to as SECURE 2.0. Note that the Act has not been passed by either the Senate or the House of Representatives, and the legislature language may change as the bill progressives. The SECURE Act increased the required minimum distributions (RMD) beginning date for IRA distributions from age 70½ to age 72. The Act would increase the required beginning date further to age 75. The Code imposes a 50% excise tax on any missed RMDs. The Code imposes the excise tax on the participant, not the plan or the plan sponsor. The Act would reduce the penalty for failure to take RMDs from 50 to 25 percent. If a failure is in an IRA, the Act further reduces the excise tax from 25 percent to 10 percent, if the error is corrected timely. Treasury regulations relating to required minimum distributions (“RMDs”) contain a rule intended to limit tax deferral by precluding annuity products from providing payments that start out small and increase over time. The test can prohibit provisions that provide only modest benefit increases under life annuities. For example, the test can prevent guaranteed annual increases of only 1 or 2%, return of premium death benefits and period certain guarantees. The Act would eliminate this restriction, allowing for more flexibility in annuities paid from qualified retirement plans.

Qualifying longevity annuity contracts (“QLACs”) are deferred annuities that begin payment well after retirement. QLACs are a way for retirees to hedge against the risk of outliving their retirement savings. The Act contains provisions making use of QLACs more practical. The treasury regulations exempt QLACs from the RMD rules until payments commence. However, the regulations imposed certain limits on the exemption. The Act would repeal the limit that the QLAC premium cannot exceed 25% of the participant’s account balance and raise the limit on the overall amount of the premium payment from $135,000 to $200,000. The bill also would allow for QLACs with spousal survival rights.

Update: June 2021:

The House Ways & Means Committee voted May 5th 2021 to approve H.R. 2954, “The Securing a Strong Retirement Act of 2020”. aka Secure Act 2.0. The revised bill is off to the House of Representatives for consideration which has bipartisan approval. The final bill is in the last step with for on the details below:

1. RMD (Required Minimum Distribution increase in 2032 to age 75

2. 401K , 403bb, and 457 plan option of receiving matching contributions in Roth accounts

3. QLAC calculations will included all tax deferral accounts and have spousal income joint income options

4. Allow variable annuities to have EFT's in the sub accounts in individual accounts.

5. Increasing the features on annuities in qualified plans and IRAs to included COLA and death benefits

Update: September 2021:

One form of annuity might be about to undergo a facelift. The regulations governing qualified longevity annuity contracts, or QLACs, would be modified under bipartisan retirement legislation currently pending in both the House and Senate. Although the contents of the two chambers differ somewhat, both would eliminate the 25% restriction on how much of your retirement funds you can put into these insurance choices and provide purchasers a 90-day free-look period.

The current 25% cap on how much of your retirement money you can spend to buy a QLAC is $135,000, and it can't be more than that (2021 limit). In the Senate's version of the retirement bill, that figure would be increased to $200,000. Money used for the QLAC is not counted toward the statutory minimum distribution until you start receiving the income. (RMDs are the daily quantities that must be taken starting at the age of 72.) . In general, the longer the QLAC deferral time, the greater the income payments. However, you must begin the income stream by the age of 85.

Update: March 2022:

Qualifying longevity annuity contracts (QLAC) are an important part of retirement planning and can provide tax-advantaged income in retirement. The dollar limitation on premiums paid with respect to a qualifying longevity annuity contract under § 1.401(a)(9)-6, A-17(b)(2)(i) of the Regulations is increased from $135,000 (2021) to $145,000 (2022). For those looking for additional income in retirement, a qualifying longevity annuity contract may be the right solution for you to request a free consultation to learn more about QLAC, qualifying longevity annuity contracts!

Update: January 2023:

The QLAC (Qualified Longevity Annuity Contract) new rules are designed to help individuals protect their retirement savings from market volatility and outliving their savings. Previously, accounts were capped at $135,000 in QLACs or 25% of the total account value. Now, that limit moves to $200,000 and removes the 25% cap. The new rules allow individuals to purchase a QLAC, which is an annuity contract that provides a guaranteed income stream for life beginning at age 85 or later. This can be used as an additional source of retirement income and helps ensure that individuals have enough money to cover basic living expenses throughout their retirement years. The new rules also provide tax advantages for those who purchase a QLAC, making it an attractive option for those looking for additional security in their retirement plan.

Update: March 2023:

With the increase $200,000 limits, QLACs can be utilized as a type of long-term insurance by some individuals. They purchase these QLACs at the beginning of their retirement with payments starting in their late 70s or beyond, when the necessity for long-term care is likely to arise. This income from QLACs, when combined with Social Security, ensures that they have sufficient income to cover any long-term care expenses. If long-term care is not required, the income from QLACs ensures that they will never run out of money, regardless of fluctuations in their investment portfolios, and supplements other income sources, restoring purchasing power lost due to inflation. Contrary to popular belief, QLACs are not a use-it-or-lose-it asset. You can set up the QLAC (Qualifying Longevity Annuity Contract) to provide income to both you and your spouse until you both pass away, even if your spouse did not contribute to your IRA.

Update: May 2023:

The rule that used to restrict the value of a QLAC to 25% of the account's value was repealed by the Secure 2.0 Act. The law also increased the cap to $200,000 from the previous limit of $125,000 for the value of the QLAC (the $200,000 cap will be adjusted for inflation in subsequent years). The law also allows for a "free-look period" of up to 90 days, during which the taxpayer may return the QLAC they purchased without incurring any fees. The new law made it clear that if the QLAC was purchased with joint and survivor annuity benefits for the person and a spouse, and assuming that the contract was legal under the rules in effect at the time of purchase, a divorce taking place after the initial purchase and before the QLAC is terminated will not affect the contract's ability to continue. In the future, the most recent modification to the QLAC regulations may make these kinds of longevity insurance contracts much more desirable and, depending on the client's circumstances, may lead to a reduction in RMD obligations in subsequent years.

Update: June 2023:

The handling of Qualified Longevity Annuity Contracts (QLAC) under divorce orders or separation agreements (which include both QDROs and DROs) under Section 202 of the Act has undergone a minor regulation modification. Though the rise in the QLAC limit to $200,000 (indexed) and the elimination of the 25% account balance restriction under that Section have been extensively covered, Section 202(b) is a term that is more likely to have broad, institutional influence.

Section 202(b) makes no legislative changes to any of the Internal Revenue Code's provisions; instead, it directs Treasury to revise its QLAC regulations, which are buried within the necessary minimum distribution applicable to DC plans that purchase annuities (Treas. Reg. 1.401(a)(9)-6). The regulations must be changed to reflect that if a QLAC is issued as a joint and survivor annuity (which it must be unless spousal consent is obtained, under plans to which such rules apply), and a divorce occurs later, the DRO "will not affect the permissibility of the joint and survivor annuity benefits" as long as that order:

• provides that the former spouse is entitled to the survivor benefits under the contract;

• provides that the former spouse is treated as a surviving spouse for purposes of the contract;

• does not modify the treatment of the former spouse as the beneficiary under the contract who is entitled to the survivor benefits; or

• does not modify the treatment of the former spouse as the measuring life for the survivor benefits under the contract.

In these instructions, there are a number of technical challenges to sort through, not the least of which is determining the meaning of the phrase "will not affect the permissibility of the joint and survivor annuity benefits." Surprisingly, this adjustment is retroactive to the QLAC reg's initial effective date of July 2, 2014, which may provide a few more issues. while there is a QLAC in a plan, it signifies that a diverse range of specialists may be required to go through this issue while addressing a domestic relations concern.

Update: January 2024:

In EY white paper we explore how a deferred income annuity aka QLAC with increasing income potential (DIA with IIP), into a financial plan provides value relative to an investment-only strategy of withdrawal income. The finding saw a 30% QLAC deposit from a retirees portfolio gave a 8.2% increase in lifetime income and 3.7% increase in potential legacy value of the total portfolio. The EY analysis suggests that the investment-only strategy is inefficient from a retirement income and legacy perspective. An integrated approach of QLAC and investment only withdrawals can give comfort and peace of mind to retirement investors by providing, tax-deferred savings growth, and guaranteed income for life without sacrificing their present lifestylex

QLAC Qualified Longevity Annuity Contract | RTG | Copyright © QLAC Quote 2012-2023 | Legal | Income Quote | LongevityInsurance.com | Spia.io | Annuity Look